PS#096: My 4-Step Guide to Market Sizing (Part 2)

Last issue, we started our series on market sizing.

We discussed the purpose for this analysis, timing in the diligence process, and a high-level view of my 4-step guide.

Today, we’re going to walk through that 4-step guide in detail, covering the following steps…

Define the target customer

Perform top’s down analysis

Perform bottom’s up analysis

Review potential growth opportunities

Alright, let’s dive in.

(1) Define the target customer.

Step (1) in my process is about intimately defining the target customer.

For those of you that have experience with marketing or have taken a marketing class, this might look a bit familiar.

In order for us to properly estimate the size of a market, we need to understand who is in the market and how they behave. We’ll break this down into 3 additional steps…

Define the use case for this product/service.

Identify & separate potential customer segments.

Understand the purchasing habits or contract terms for each product/service.

Let’s look at each of these steps in a bit more detail…

(A) Define the use case for this product/service.

First, we need to understand the problem or need that this product and/or service is solving. This will give us a better sense of how customers are solving the problem today and the competition that exists in the market, including direct/indirect competition, alternative solutions, and the status quo.

(B) Identify & separate potential customer segments.

Next we want to outline the different customers that are (or are intended) to use this product/service. We want to be able to describe the specific characteristics for each customer profile. This can include all kinds of details, such as individual vs. business, demographics, geographic location, interests, values, etc.

There’s all sorts of ways to break this down. We want to be able to group these customers into categories that help us best understand the market.

(C) Understand the purchasing habits or contract terms for each product/service.

Finally, we want to understand the purchasing habits of these different customer segments, including (1) how often they are purchasing and (2) in what quantity. Of course, this will look different from industry to industry, company to company, product to product, etc.

Most startups will have some sort of historical data (or expectations) on all of these items. It’s our job (as investors) to make sure we leverage our trusted networks to develop our own perspective and conclusions for these data points.

(2) Perform top’s down analysis.

Alright, once we have an intimate understanding of the customer, we can start looking at the market from a 30,000 foot view.

We’ll start by looking for research on the market in question, leveraging key terminology, descriptions, criteria, etc. that we uncovered in our customer research. For this process, we can use some of the readily available sources in the market, including…

Market research firms

Consulting firms

Industry-specific sources

Let’s discuss each of these a bit more…

Market research firms.

In terms of market research, there’s a lot of companies that provide high level information on different sectors (e.g., Pitchbook, Crunchbase, CB Insights, Grandview, Research & Markets, IBIS World, Statista, Persistence Market Research, etc.). Some investors will buy these reports and use them as a starting point.

Personally, I’ll just read what’s freely available and start building a better foundation for some of my more detailed analysis (i.e., Steps 3 & 4).

Consulting firms.

Consulting firms will also provide a good source of high-level information. This could include boutique firms or some of the larger, blue-chip consulting firms (e.g., McKinsey, Bain, BCG, Deloitte, E&Y, PwC, KPMG, etc.).

In looking for these sources, I usually add the firm name next to the chosen market terminology (i.e., “[market terminology] + McKinsey report”). Even better, if possible, I recommend reaching out to the individuals who wrote the report and setting up a discussion.

Industry-specific sources.

Some of the best information comes from industry-specific sources, such as trade associations, research institutes, specialized forums, etc.

They will often have much more detailed information, especially when it comes to market sizing information. For example, if you want to understand how many attorneys operate in the US, one could look into data provided by the American Bar Association.

Just as I mentioned with the consulting firm reports, I recommend reaching out to individuals at these organizations. They know these markets intimately and can provide quality data.

After collecting all of this data, it’s important to sanity check the information.

Make sure to keep in mind the following…

Recognize that these reports are often incentivized to project a certain outcome

Understand the drivers assumed from the projections (i.e., Why do they think this will happen?)

Compare with similar or competing industries (i.e., Do the assumptions make sense? Can we learn from other industries?)

Review historical growth numbers and related drivers (i.e., What happened historically? Is this relevant for the future?)

(3) Perform bottom’s up analysis.

With the first two steps completed, we have a good foundation for diving into the deeper, more detailed levels of this analysis – bottom’s up analysis.

Just as the title indicates, we’re going to be building our analysis from the smallest atomic parts to get a sense of the size of this market. This means we will need to have the following…

Customers organized into their different segments

Number of customers in each segment

Purchasing habits, including…

Pricing

Number of purchases (e.g., user seats, per period, items, etc.)

Length of contract

Let’s take a B2B software solution as an example.

If you look at the chart below, we’ve organized the customers by segment, identified the number of customers, estimated the pricing range (i.e., contract value), and then calculated the annual revenue opportunity range (i.e., # of customers multiplied by the contract value range).

Diagram 1: Bottom’s Up Analysis

After performing the calculations, we see that there is roughly a $1-2B annual revenue opportunity, depending on the startup’s ability to price the solution.

This analysis combined with the top’s down analysis gives a few different ways of viewing the size of this market opportunity.

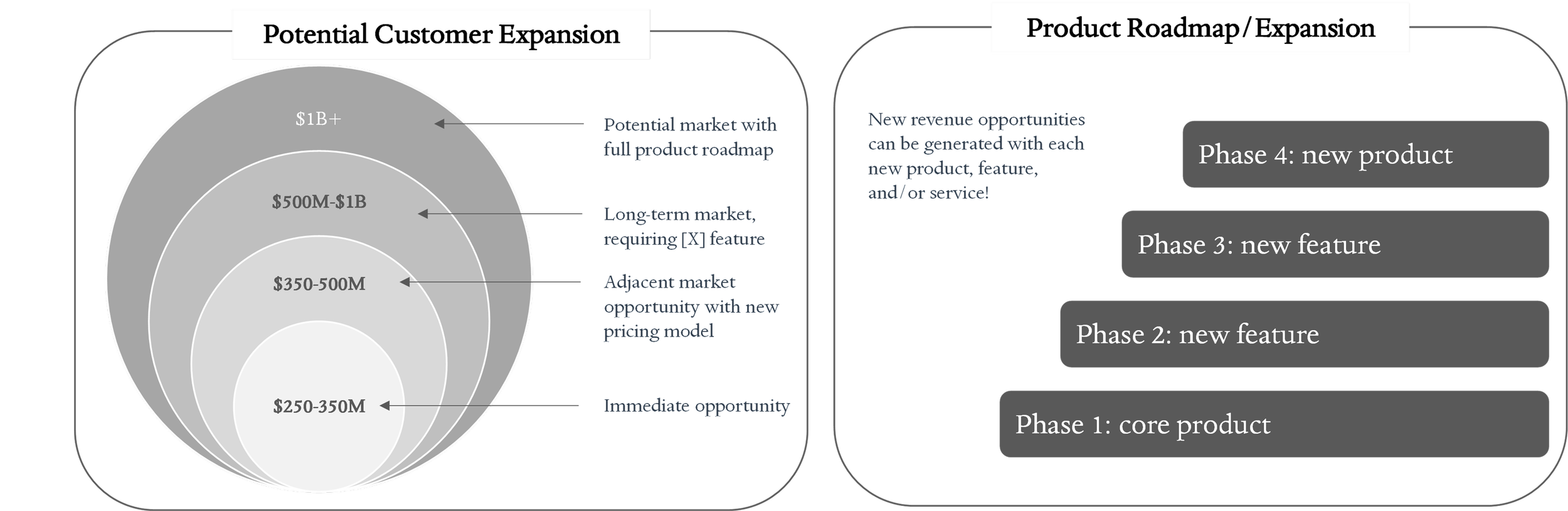

(4) Potential Growth Opportunities

Finally, we need to review potential growth opportunities or how the market will change over time.

As I mentioned in the last issue, market sizing is an art as well as a science. We need to be able to use our imagination to think through how this market will change, grow, and evolve. This is especially important as we look into new technologies that might be creating entirely new market opportunities (i.e., Apple’s iPhone, OpenAI, etc.).

To help structure our creativity in this step, we should think through changes along the following dimensions…

New problems

New customer segments

Adding different products or service

Adjusting pricing and/or contract terms

As the startup grows, there will likely be opportunities for them to expand their market across several of these concepts.

The visual below helps illustrate how the market opportunity might change over time.

Diagram 2: Potential Growth Opportunities

And there we have it.

My 4-step guide to market sizing.

Next issue, I’m going to share some additional things to consider, as well as some rules of thumb for performing market sizing in the venture world.