PS #067: 2024 VC Compensation Report

It’s time for everyone’s favorite topic – compensation.

To help prepare you for the upcoming recruiting season, I wanted to provide a refresh on my original venture capital compensation report.

If you’re just joining us, I highly recommend reading through the original article. In addition to specific compensation details, I walk through how VC compensation works and how to approach an offer. We’ll discuss this in a bit more detail over the next few issues, but it’s a great place to start.

Today, we’re going to focus on the latest market compensation.

Methodology

Before we dig into the data, some notes on the information collected:

This data was drawn from 330+ VCs in the EVCA community. If you’re new to the venture capital community, I highly recommend applying to join!

All of the respondents are analysts, associates, senior associates, vice presidents, or principals on the investments team at institutional, corporate, or crossover (private & public) funds.

Cash compensation refers to salary + bonus.

Carry points refer to percentage points (i.e., 1.00 point = 1% of the carry).

The data has been classified by stage (which often drives fund size), defined as:

Pre-seed / Seed

Early-stage: Seed to Series B

Growth-stage: Series C to IPO

Stage Agnostic: Seed to IPO

The output of the information has been broken down by role.

Alright, with that being said, let’s get started.

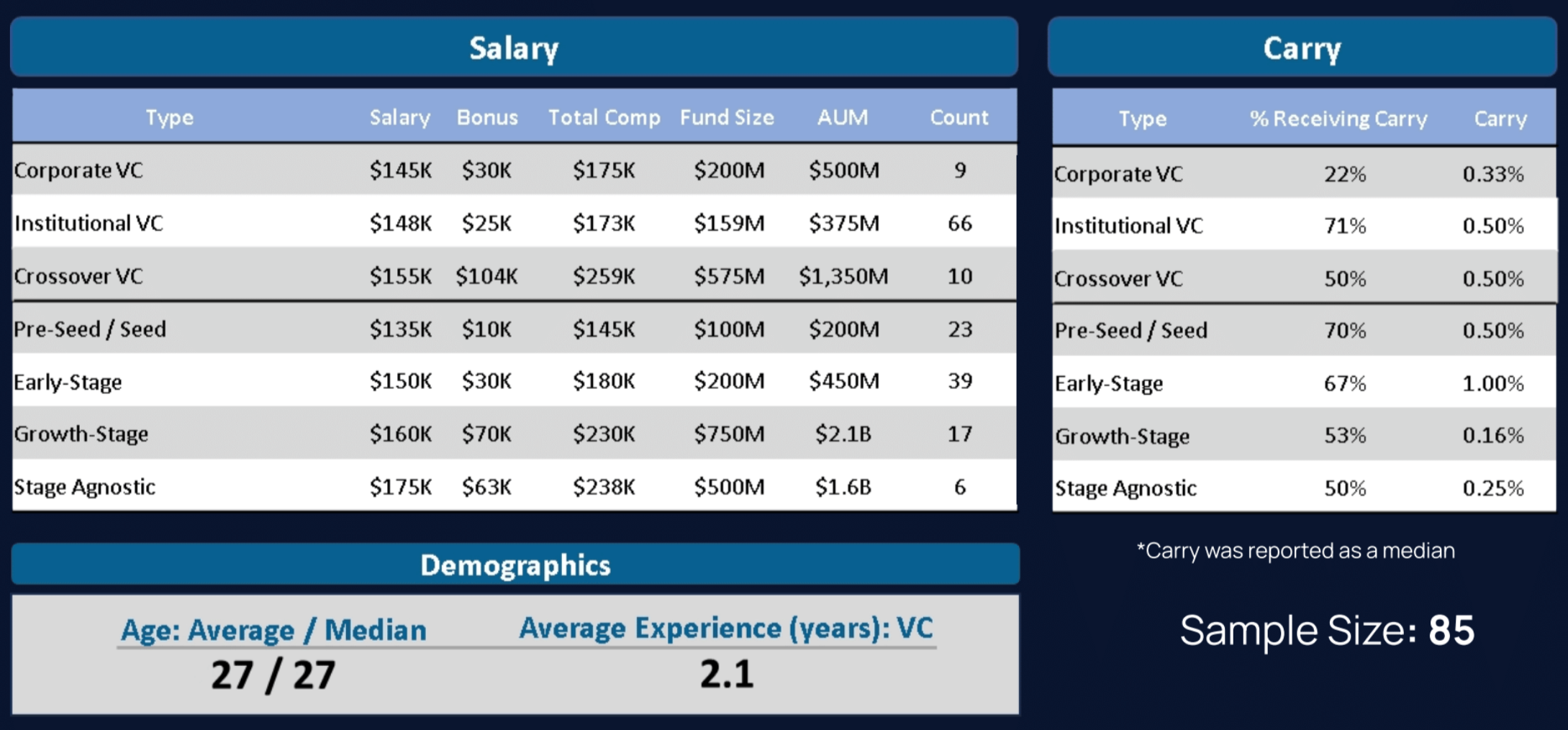

Analysts

Analysts are entry-level roles with 1-3 years of experience.

Total cash compensation: Average about $113k, but that’s a bit elevated due to growth salaries.

Carried interest: Less than a third of analysts actually received carry (with the amount being relatively small).

Associates

Associates usually have 2-5 years of experience, depending on the firm.

Total cash compensation: This is where you’ll really start to see a difference in compensation due to stage and total fund size. Early stage investors can expect compensation ~$150-175k, while associates at larger, growth funds can expect compensation in the $230-250k range.

Carried interest: More associates are receiving carry as of late, but again, the amount in most cases is small.

Senior Associates

Senior associates usually have 4-8 years of experience depending on the firm (with slightly less pure VC experience).

Total cash compensation: Hovers around $175-215k (about a $30-40k bump from associate) for early stage investors, with later stage investors grossing between $260-300k.

Carried interest: The majority of senior associates will receive carry (usually around 1%).

Vice Presidents / Principals

Vice Presidents & Principals tend to have 8+ years of experience with 4+ years in venture.

Total cash compensation: Compensation is $250k+ for all except for pre-seed/seed firms, and north of $300k for growth-stage investors.

Carried interest: Nearly all receive carry, typically around 3% or less.

Putting it into context.

Now that we have the latest information in regards to compensation, we’re going to layer in some additional context.

Over the next few issues, I’m going to share how this information has trended over the past few years, as well as what this means as you start recruiting for full-time roles.

My hope is that this information (combined with the appropriate context) will help give you a better foundation for securing and negotiating a full-time role in venture.